Top 3 challenges in COVID-19 vaccine development versus traditional vaccines

The current COVID-19 pandemic is spreading with high speed. It took six months from the beginning of the pandemic to reach ten million infectious cases worldwide. Six weeks later the number of COVID-19 cases surpassed 21 million and as of October 2020 we count more than one million deaths worldwide.

As we previously reported, the number of vaccine candidates undergoing active research continues to rise (close to 200). This push is driven by the urgency of the situation and the international pressure to fight the pandemic.

However, developing a safe and effective-vaccine against COVID-19, with minimal adverse effects - is not that simple. Avertim is involved in several COVID-related project, whether it is in the diagnostic, clinical phases or also manufacturing ramp-up. We are well positioned to observe the current challenges and propose appropriate measures. Here are some insights

Challenge 1: The timelines to develop safe and effective vaccines against COVID-19 are very challenging!

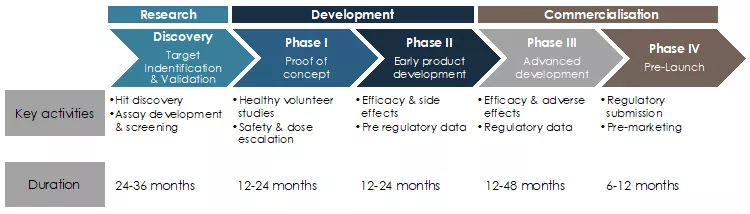

The development of traditional vaccines can require more than 10 and sometimes even 20 years from project start and initial discovery until the final approval of a new product. The chart below represents the different steps, as well as the typical lengths of these steps as reported by the FDA.

Figure 1: Typical development life cycle of pharmaceutical products such as vaccines1

Necessity and opportunities to shorten vaccines development, manufacturing and commercialization steps

Although development phases are traditionally very long, it took only five and a half years to develop the recently FDA-approved Ervebo vaccine against Ebola, a vector based genetically modified vaccine produced by Merck & Co Inc. This has been deemed a huge success. Many lessons can be learned from this achievement for the current pandemic vaccine development.

The goal for all COVID-19 vaccines is to achieve safe and effective results even faster than Merck & Co Inc. did with Ervebo, leading to a challenging timeframe of 12 to 18 months for total project length. The first companies involved started their research around January and February 2020.

In order to reduce the timescale from vaccine discovery and development to final approval and manufacturing for the COVID-19 vaccine, the pharmaceutical industry is working under high pressure to fast track the vaccine development and commercialization.

Some of the measures and strategies helping to shorten the different steps are:

- More international scientific and development cooperation between research institutes and pharmaceutical companies to share sequencing data of the COVID-19 genome, findings from different studies on the disease and symptoms, but also for collecting preclinical data and findings during clinical trials, etc.

- Early sharing of vaccine protocols and data results as it has recently been the case with Pfizer, Moderna and soon AstraZeneca

- Intensive planning activities for clinical trials (e.g. fast-tracks and high priority for patient enrollment)

- The health authorities’ fast-track regulatory programs such as the “Coronavirus Treatment Acceleration Program” (CTAP) created by the FDA as “a special emergency program for possible coronavirus therapies”. The FDA and other health authorities world-wide are mobilizing their resources and prioritizing for anything related to COVID-19 vaccines. The European Medical Agency has also mobilized resources and accelerated their support for fast-track COVID-19 programs in their emerging health threats plan and pandemic task force (COVID-ETF). All for the goal of rapid approval and market entry of vaccines while simultaneously safeguarding patients by evidence based and sound scientific assessments

- Frequent discussions and alignment with regulatory agencies, as well as governments and the WHO’s leadership have proven to be effective in the case of the Ebola vaccine. Public-Private-Partnerships are in this regard helping by leveraging the required expertise from different organizations

- Pharmaceutical companies are also collaborating in an unprecedented way to share manufacturing capacities (details further below in the article). Building new factories from scratch rarely takes less than 3 years until final commissioning but such a timeline is not allowed

- In the case of COVID-19, several companies have started producing their vaccine months before testing the first dose on a human being, in the hope to get millions of doses ready in time. Some vaccines components are also used indiscriminately for different vaccines including the COVID-19 vaccines. They can therefore already be produced as it is the case for GSK’s adjuvant system AS03 which will be used for Sanofi’s vaccine

- Increased financial support (and faster reaction) from public and private funding to cover costs for development efficacy trials, manufacturing and other activities

170+ vaccine candidates trying to shorten timelines against COVID-19

Due to urgent demand of such vaccines, intense global efforts in R&D activity around the world have been triggered to accelerate the development of COVID-19 vaccines. Pharmaceutical companies and researchers across the world have never before worked together in such intensity and at such a pace, with more than 170 projects using different technology platforms in the race for COVID-19 vaccines. The larger the variety of the approaches, the higher the chance to get a safe and effective vaccine on the market quickly.

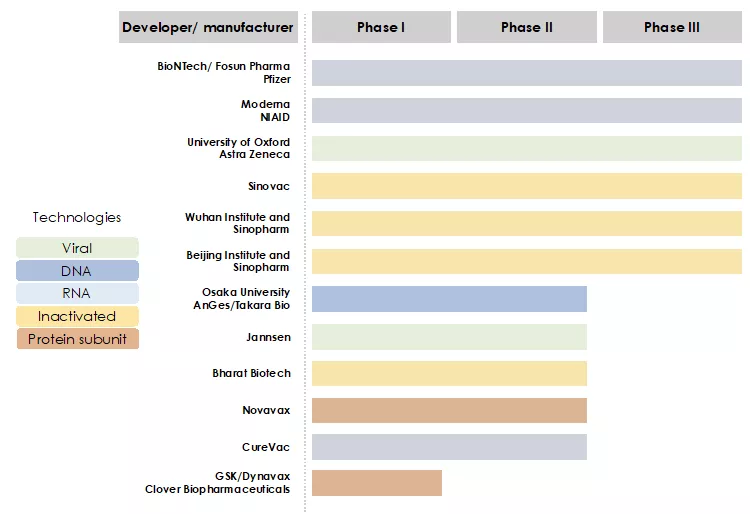

An overview of the progress of vaccines candidates in clinical trials is presented in the Figure 2 below. The most advanced projects include:

- The RNA vaccine projects of BioNTech-Fosun-Pfizer and Moderna-NIAID

- The non-replicating viral-vector based vaccine project of University of Oxford-Astra Zeneca

- The inactivated virus vaccine projects of Sinovac, Sinopharm-Wuhan Institute, Sinopharm-Beijing Institute

Figure 2: The race for COVID-19 vaccines in clinical trials

We have reported about the progress of these candidates during the months of June-September in this article.

Are you confused about the different vaccine technologies? Check out our quick guide here.

The safety of vaccines has the utmost priority

To ensure the success of vaccination, the safety of vaccines must be a priority. Like for any other medicine, no vaccination can be ascribed as totally risk-free.

Nonetheless, vaccines are usually administered to healthy and not to sick people, which drastically reduces the number and intensity of acceptable adverse effects. Stronger adverse effects, such as those that seriously ill patients would accept with life-saving drugs, can't be accepted in a vaccine. Scientifically sound and evidence-based assessments must be made before adaption of a vaccine, even if there is little time. Especially knowing, that there have been cases of severe and unexpected outcomes in vaccine usage in the past like with the dengue vaccine. After administering the patient's body reacted unexpectedly and made the disease more dangerous due to a process called “vaccine-induced enhancement”. Any potential risks or side effects of vaccines must be investigated by rigorous scientific assessments and clinic trials conducted by hospital teams along 3 successive phases to understand the virus itself and how it affects the human immune system.

Failures will also occur with COVID-19 vaccines

The major obstacle that pharmaceutical companies are facing in the development of novel drug products is the overall low success rate to complete the development cycle.

As an example, between 2002 and 2021, a staggering 99.6% of drug substances against Alzheimer’s disease (AD) failed to pass the three clinical phases. 244 compounds were in clinical trial evaluations but only one has been approved for marketing. The attrition rate for AD treatment is high, with 72% of agents failing in Phase 1.92% failing in Phase 2, and 98% failing in Phase 3 in the period observed.2 We can definitely expect failures also with COVID-19 vaccines and a number of the current candidate will not be put to the market.

Challenge 2: Manufacturing at large scale

Vaccine production is a complex process and becomes a bigger challenge for vaccine manufacturers in COVID-19 outbreak situations because they need to launch and quickly scale-up their production to hundred of millions or even up to billions of vaccine doses.

Production facilities are built to suit a given vaccine since each vaccine requires different equipment and bioprocesses. Vaccines manufacturing plants need to be prepared, qualified, validated, inspected and approved according to the Good Manufacturing Practices as well as all applicable standards and regulatory guidelines (e.g. FDA, EU GMP Guideline). Even then, they will be regularly inspected and audited by their local and all international regulatory agencies of the countries where their vaccine is approved.

Furthermore, manufacturing a vaccine requires a large number of raw materials, which must be of highest possible purity and undergo strict quality control to meet the quality specifications, before being used in manufacturing. Their origin must be properly traced, and their regular delivery must be ensured. Apart from qualification and validation activities, this calls for quality agreements, the assessment of supply chains and audits at the supplier's facilities.

At the same time, the vaccine components and the final products must pass a rigorous array of quality control tests for purity, sterility, potency, consistency, activity and stability, etc. before they can be released.3,4

Collaborating to manufacture at scale

Unprecedented spirit of collaboration and cooperation is shared among vaccine developers and manufacturers across the world to speed up the launch of the COVID-19 vaccine.

BioNTech and Pfizer are working to scale up their manufacturing capacity for their RNA vaccine candidates. Pfizer has identified four potential facilities globally to produce the COVID-19 vaccines.

BioNTech will increase production at its German facilities. The German biotech has also announced a takeover of one of Novartis’ former flu vaccines production unit in Marburg, eying capacity of up to 750 million doses annually.

The US company Moderna made a deal with Lonza for the production of its potential COVID-19 vaccine in Portsmouth, USA and in Visp, Switzerland. The Serum institute of India and other companies will produce the ChAdOx1 vaccine of Astra Zeneca and Oxford university (see table 1).5,6

| Developer/ manufacturer | Vaccine candidate | Produced by/in |

BioNTech Pfizer | BNT162 | Mainz and Idar-Oberstein (Germany), Puurs (Belgium), |

| CureVac | CVnCoV | Tübingen, Tesla |

Janssen (Johnson&Johnson) | Ad26.COV2-S | Bümpliz (Switzerland), Leiden (Netherlands), Catalent Biologics (USA), Emergent BioSolutions (USA) |

| Moderna | mRNA 1273 | Lonza (in Portsmouth, New Hampshire, USA and in Visp, Switzerland), filing in Catalent (USA) |

| Novavax | NVX-CoV2373 | Emergent BioSolutions (USA) Praha Vaccines (Czech republic) |

Oxford university Astra Zeneca | ChAdOx1 | AstraZeneca, Serum Institute of India, Halix, Pall Life Science, Cobra Biologics, Oxford Biomedica, Bioscience (South Korea), R-Pharm (Russia), Vaccines Manufacturing and Innovations Centre (VMIC, Great Britain) |

| Sanofi and GSK | Adjuvanted, recombinant COVID-19 vaccine candidate | $2.1 billionfrom Operation Warp Speed of US Government |

Table 1: Cooperation in vaccine production 5

Challenge 3: Financing issues as obstacles to development and production of vaccines

The costs associated with development and production of new vaccines include costs for research and development (R&D), clinic trials, regulatory approval processes, factories and marketing. Launching a new vaccine often requires $1 billion to get to licensure. In order to accelerate COVID-19 vaccine development processes, a lot of public and private grant funding programs have been established globally: the Coalition for Epidemic Preparedness Innovations (CEPI, co-founded by the Bill and Melinda Gates Foundation, the Welcome Trust and the Governments of Japan, Norway and Germany)7, the EU Commission, the German Federal Ministry of Education and Research (BMBF), the US Biomedical Advanced Research and Development Authority (BARDA), the US Department of Defense, Operation Warp Speed founded by the US government (see table 2).5,8,9

| Developer/ manufacturer | Vaccine candidate | Financial support |

BioNTech Pfizer | BNT162 | Horizon 2000 InnovFin, BMBF |

CureVac | CVnCoV | CEPI, EU Commission, German Federal Government |

Janssen (Johnson&Johnson) | Ad26.COV2-S | $1 billion from BARDA and US Department of Defense |

| Moderna | mRNA 1273 | CEPI, $2.48 billion from BARDA |

Novavax | NVX-CoV2373 | $1.6 billion from Operation Warp Speed of US Government |

Oxford university Astra Zeneca | ChAdOx1 | CEPI, BARDA, UK´s Institute for Health Research, UK Research & Innovation |

Sanofi and GSK | Adjuvanted, recombinant COVID-19 vaccine candidate | $2.1 billion from Operation Warp Speed of US Government |

Table 2: Financial support in vaccine development and manufacture5

NB: data as of end of September 2020. Subjects changes given the fast speed of COVID-Vaccine development.

How companies finance their COVID-19 vaccine projects

Pharmaceutical development and manufacturing companies have different ways to finance their projects, among which:

- Vaccine companies get down payments from pre-orders made by governments or organizations to secure the access to vaccines in case they pass clinical trials. The European Union has paid AstraZeneca €396 million for 300 million doses of its potential COVID-19 vaccine.

- Companies also loan money from banks to finance research and development stage as well as clinical trials. On July 6, European Investment Bank and CureVac signed €75 million loan agreement for the development and large scale production of vaccines.

- Moreover, companies are in the search for strategic investors with the purpose of financially supporting vaccine development. The German Government invested €300 million ($343 million) for a 23% share and GSK made an investment of €130 million ($171 million) for 10% share in CureVac company.

Many other obstacles are still ahead especially in the delivery phases as reported by DHL in a recent paper. Stay tuned for more updates soon!

You want more information about Avertim services in the Life Sciences & vaccines area?

Visit this page Avertim in Life Sciences & Chemicals or Contact us

Our next article we will discuss about the development cycle of a vaccine from lab to clinic.

References

- FDA. Step 3: Clinical Research. https://www.fda.gov/patients/drug-development-process/step-3-clinical-r….

- Cummings, J. L., Morstorf, T. & Zhong, K. Cummings, Jeffrey L_Alzheimer’s_drug development candidates failures_2014. 1–7 (2014).

- Kanesa-thasan, N., Shaw, A., Stoddard, J. J. & Vernon, T. M. Ensuring the optimal safety of licensed vaccines: A perspective of the vaccine research, development, and manufacturing companies. Pediatrics 127, (2011).

- Cunningham, A. L. et al. Vaccine development: From concept to early clinical testing. Vaccine 34, 6655–6664 (2016).

- vfa. Impfstoffe zum Schutz vor Covid-19, der neuen Coronavirus-Infektion. https://www.vfa.de/de/arzneimittel-forschung/woran-wir-forschen/impfsto….

- Hargreaves, B. Pfizer and BioNTech work to scale up COVID-19 vaccine production. https://www.biopharma-reporter.com/Article/2020/05/11/Pfizer-scales-up-….

- Coalition for Epidemic Preparedness Innovations (CEPI). https://www.gesundheitsforschung-bmbf.de/en/coalition-for-epidemic-prep….

- Financing Vaccines in the 21st Century: Assuring Access and Availability. Vaccine Supply. https://www.ncbi.nlm.nih.gov/books/NBK221811/.

- Poland, G. A., Whitaker, J. A., Poland, C. M., Ovsyannikova, I. G. & Kennedy, R. B. Vaccinology in the third millennium: Scientific and social challenges. Current Opinion in Virology vol. 17 116–125 (2016).